Want to know how to get a Surge Credit Card? Well, You’re in the right place! This guide will help you figure out the steps to apply for one.

Whether you’re new to credit cards or just exploring your options, We’ll make the application process clear and straightforward.

So, Let’s get started understanding how to apply for a Continental Finance Surge Credit Card.

How to Apply for a Continental Finance Surge Credit Card?

The Surge Mastercard is becoming popular because it offers a lot of good things. If you don’t have one yet, Find out how to apply for it:

Apply Online

- Go to the Surge Credit Card at www.surgecardinfo.com/index.html.

- Click on the “Apply Now” option.

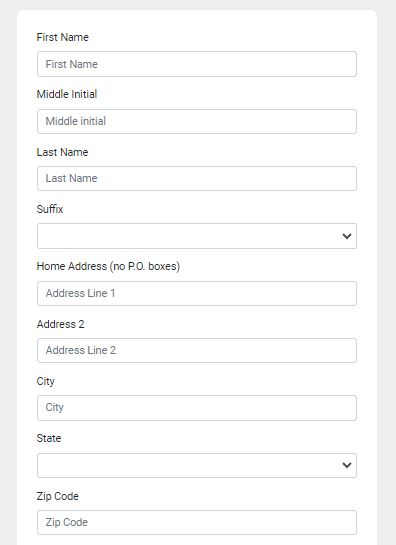

- Fill out the Application form. Enter the details like name, address, email ID, SSN, Zip code, and Your Total Monthly Income.

- Also, Enter your Primary and secondary phone number, and DOB.

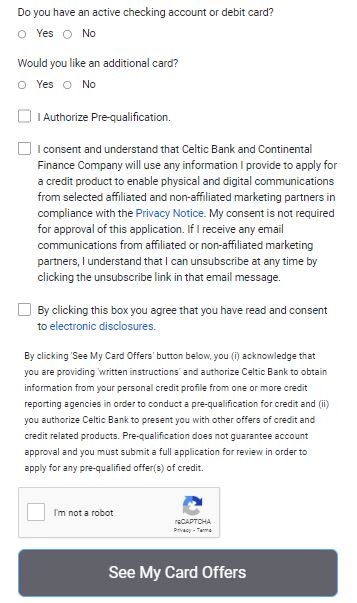

- Read all the Privacy and electronic disclosures, Click the box to agree to all the terms and conditions.

- Solve the Human verification captcha.

- Now click on the “See My Card Offers” option.

- Scroll through the different Credit Card offers and choose which one you want.

- Apply for the credit card offer.

- Finish the process and Complete the online application.

Apply By Phone

To apply by phone, you can call the phone number for Continental Finance at 1-866-513-4598. To apply via the mail, you can return the acceptance form you received with the pre-selected offer that arrived in your mailbox.

Benefits of Applying for a Surge Credit Card

- Free credit scores each month.

- Apply for a higher credit limit after 6 months of membership.

- No security deposit is required for up to $1000 of credit loans.

- Users with bad credit scores can apply.

- A starting credit limit of $300 to $1000.

- Zero fraud liability feature.

- Surge will send a report of your credit profile every month to American Credit Bureaus (TransUnion,

- Experian, Equifax).

- Easy to build a better Credit Card Score.

- Make minimum monthly payments.

Final Words

Getting a Surge Credit Card can be a good idea if you’re looking for a simple way to manage your money.

It helps you build credit and gives you the convenience of making purchases.

Just remember to use it wisely, Pay your bills on time, And enjoy the benefits of having a credit card that can help you in your financial journey.